Building Tomorrow’s Economy: Unlocking Growth Through Innovation

The Spring 2025 Europe and Central Asia Economic Update: Accelerating Growth through Entrepreneurship, Technology Adoption, and Innovation by the World Bank delivers a multifaceted analysis of the economic trajectory in the region, focusing particularly on how entrepreneurship, innovation, and technology adoption can address persistent growth stagnation. While the report outlines persistent macroeconomic challenges—ranging from sluggish growth to inflationary pressures—it also presents a compelling argument for reform-driven revitalization anchored in private sector dynamism.

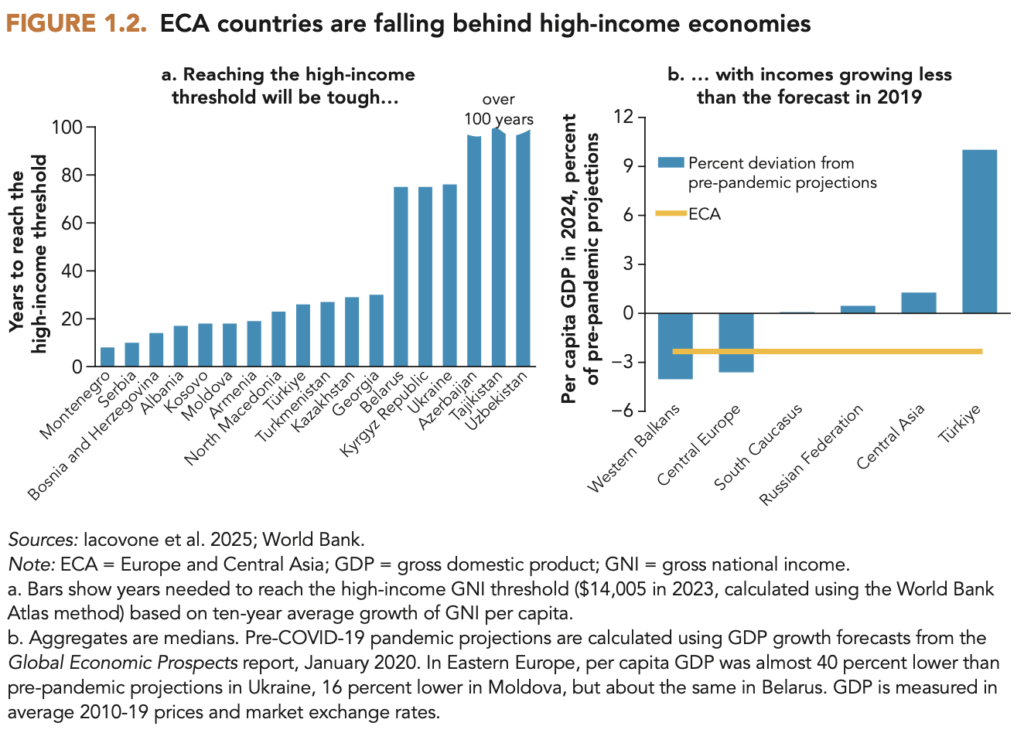

Growth in Europe and Central Asia (ECA) remained fragile in 2024 at 3.6%, slipping to 3.3% when excluding Russia, largely due to weaker external demand and slowdowns in Türkiye and Ukraine. Despite relatively strong domestic consumption supported by real wage growth, remittances, and consumer borrowing, the region continues to experience economic underperformance compared to pre-pandemic trends. Particularly alarming is the region’s growing divergence from high-income economies, with median GDP per capita in many ECA countries still lagging behind 2019 projections.

Inflation has reemerged as a critical concern. Median headline inflation rose to 5% in early 2025, primarily driven by rising food prices and labor cost-induced services inflation. Fiscal policy remains expansionary, with government expenditures increasing across two-thirds of the region. This is reflective of growing public investment and defense spending, but it has widened fiscal deficits despite earlier plans to narrow them. Meanwhile, central banks are constrained—some have hiked rates while others have paused easing efforts amid uncertainty.

The report is particularly powerful in its second part, which moves beyond macroeconomic diagnosis into the structural challenges undermining productivity and competitiveness in ECA. A central argument is the region’s overdependence on small, low-productivity firms and its shortage of high-performing, scalable enterprises. Many small and medium-sized enterprises (SMEs) benefit from blanket support, but lack the ecosystem and incentives to scale up or innovate. Moreover, a significant share of economic activity is still dominated by incumbent state-owned enterprises (SOEs), which suppress competition, deter new entrants, and distort market efficiency.

What sets this report apart is its emphasis on enterprise-level transformation as the engine of sustainable growth. The analysis highlights that innovation and technology adoption—not merely the reallocation of existing resources—must become the core drivers of productivity. Unfortunately, innovation in ECA is stunted: few firms invest in research and development, and patent activity is sparse relative to global peers. Foreign firms’ subsidiaries often operate as production sites rather than innovation hubs. Thus, the challenge is not only technological but institutional—countries must cultivate business environments that reward risk-taking and merit, not protect incumbents.

The report calls for a redirection of policy focus from generalized SME support to targeted incentives for productive firms with growth potential. Additionally, the financial sector needs reform to facilitate long-term financing and venture capital access for innovative firms. Deepening financial markets and reducing the bias of state-directed lending are seen as essential to reallocating capital more efficiently.

Finally, the report sees structural reform windows in periods of crisis. The authors stress that ongoing disruptions—from geopolitical tensions to fiscal strains—can be used as catalysts to accelerate long-overdue reforms. Policymakers are urged to improve the efficiency of SOEs, phase out harmful subsidies, and enhance competition frameworks. These changes, if implemented with resolve, could help ECA countries transition toward an enterprise-driven model of growth—one that is resilient, inclusive, and innovation-led.

In summary, the report paints a sobering yet hopeful picture. It acknowledges the daunting macroeconomic outlook, yet provides a clear and actionable roadmap for revival. If the region is to escape the low-productivity trap and close the income gap with advanced economies, bold structural reforms focused on the private sector will be indispensable.

Cover photo source: https://openknowledge.worldbank.org/server/api/core/bitstreams/f34d0317-f1ab-4e39-b209-c7e2c149de19/content

- By Strategers